Supplier management: boosting business performance, innovation and growth

Supplier management has a significant impact on business performance, given heavy reliance on an array of vendors which can play a critical role in boosting efficiency, service quality and risk mitigation. If all goes well, their services provide you with a competitive edge – boosting value...

Assets under Custody: the market share battle

For 20+ years, we have recorded the Assets under Custody and Administration of the world's leading global custodians, gathering data across a market of more than 30 asset servicing firms. The accompanying chart depicts the market share of the 'big four' providers, BNY Mellon, State Street, J.P....

Service provider excellence: 9 crucial flags

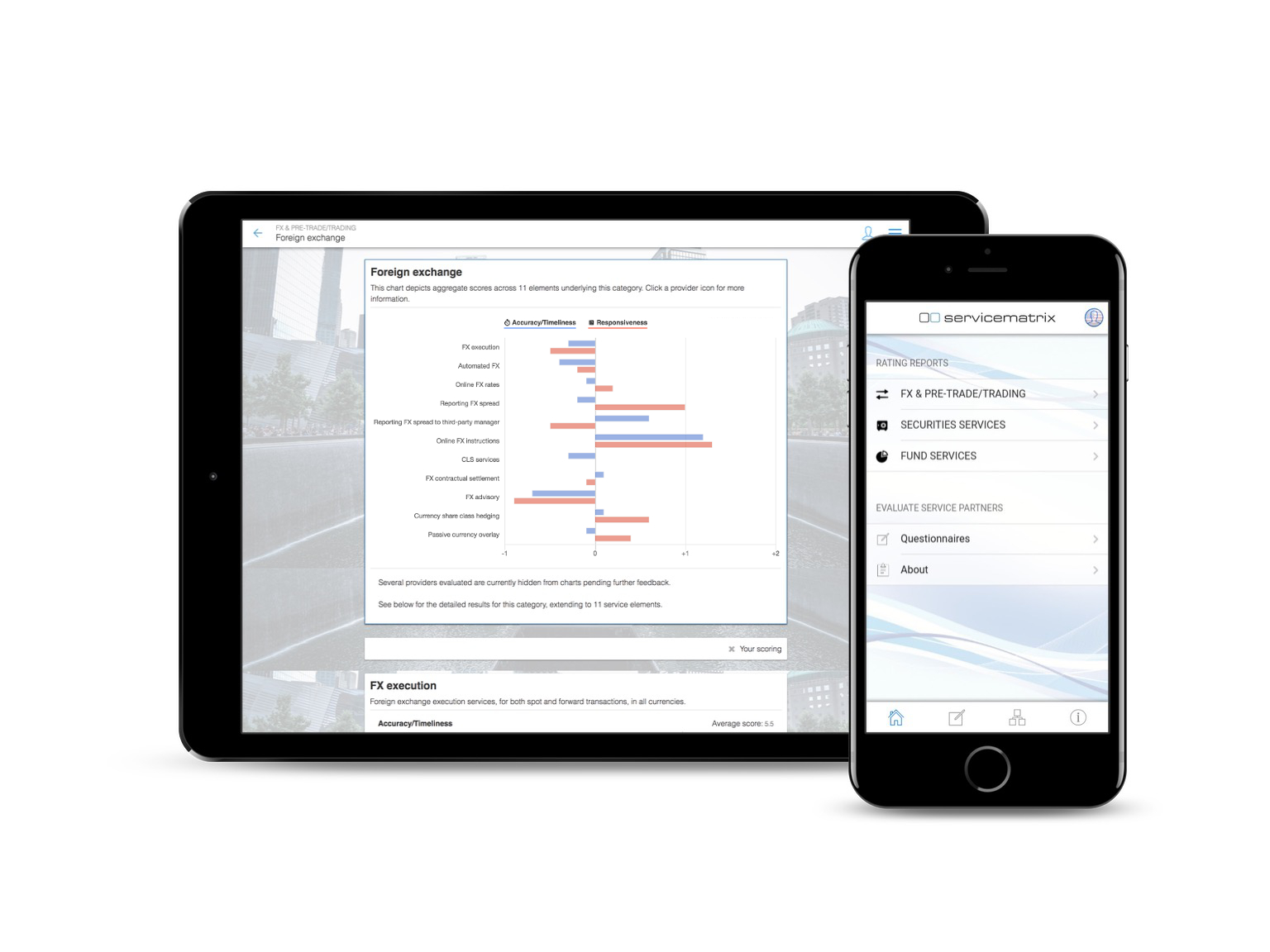

Service delivery sets vendors apart. The latest reports at ServiceMatrix present the merits of service providers in 9 key components of service excellence and across a range of services. Institutional asset owners...

Another Turning Point in the Global Custody League Table

Global custodians thrive on scale, based on the strong fundamentals of growth in their client assets driving revenue. Data on assets under custody collected by globalcustody.net over the past two decades shows healthy trend growth for the industry as a whole. Growth in assets under custody in the...

Previous

Next

Supplier management: boosting business performance, innovation and growth

Supplier management: boosting business performance, innovation and growth

Supplier management has a significant impact on business performance, given heavy reliance on an array of vendors which can play a critical role in boosting efficiency, service quality and risk mitigation. If all goes well, their services provide you with a competitive edge – boosting value...

Assets under Custody: the market share battle

Assets under Custody: the market share battle

For 20+ years, we have recorded the Assets under Custody and Administration of the world's leading global custodians, gathering data across a market of more than 30 asset servicing firms. The accompanying chart depicts the market share of the 'big four' providers, BNY Mellon, State Street, J.P....

Service provider excellence: 9 crucial flags

Service provider excellence: 9 crucial flags

Service delivery sets vendors apart. The latest reports at ServiceMatrix present the merits of service providers in 9 key components of service excellence and across a range of services. Institutional asset owners...

Another Turning Point in the Global Custody League Table

Another Turning Point in the Global Custody League Table

Global custodians thrive on scale, based on the strong fundamentals of growth in their client assets driving revenue. Data on assets under custody collected by globalcustody.net over the past two decades shows healthy trend growth for the industry as a whole. Growth in assets under custody in the...

After the tsunami...

Eric de Nexon, Head of Strategy, Market Infrastructures and Regulation, Societe Generale...

Mind the gap

For many years, supposedly sophisticated financial institutions were in the dark when it came to...

Serenity from Sibos

The word 'serenity' is not one that might immediately associated with the annual organized mayhem...

The Control Conundrum

Pension fund trustees have been through a steep learning curve. Since the global financial crisis...

Supplier management: boosting business performance, innovation and growth

Supplier management: boosting business performance, innovation and growth

Assets under Custody: the market share battle

Assets under Custody: the market share battle

Service provider excellence: 9 crucial flags

Service provider excellence: 9 crucial flags

Another Turning Point in the Global Custody League Table

Another Turning Point in the Global Custody League Table