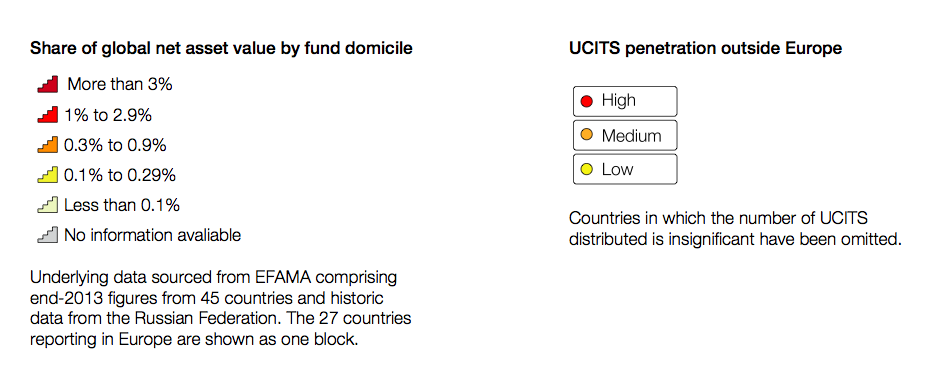

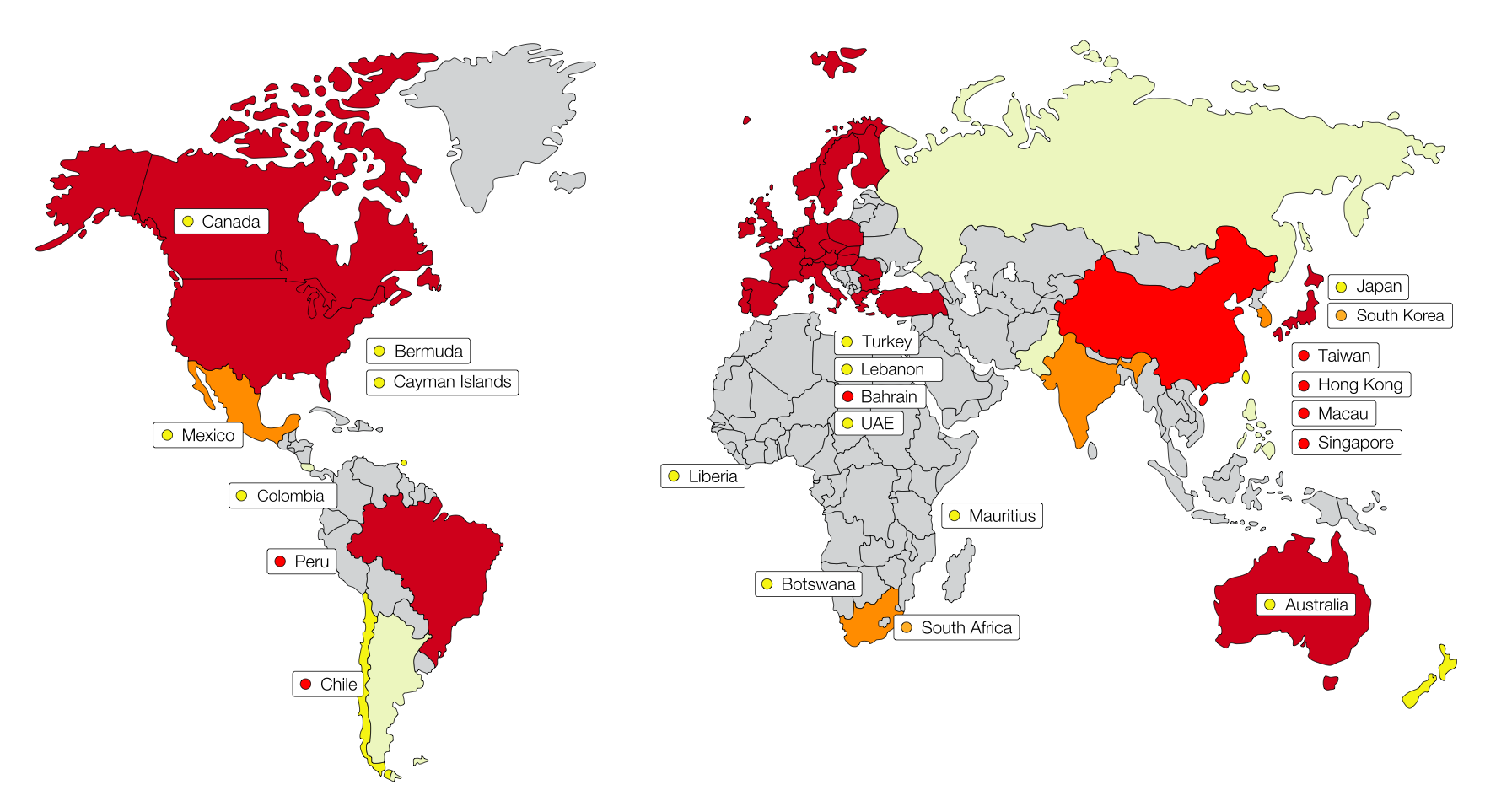

The UCITS hallmark is celebrated as the 'gold standard' for fund regulation globally. While originally envisaged as a fund passport for European markets, the UCITS structure is the vehicle of choice for distribution in many countries across all regions of the world – and has even proven popular in some countries which have mature domestic regimes.

UCITS has a particular focus on investor protection, especially in its fifth incarnation. The corresponding European Union directive – commonly called UCITS V – addresses a gap in regulatory standards exposed in 2014 with the introduction of the Alternative Investment Fund Managers Directive (AIFMD). In discussion with Arnaud Claudon of BNP Paribas Securities Services, we examine the pertinent issues for fund managers and their depositaries, administrators and external valuers.

AIFMD is an investor-protection measure governing the management and distribution of alternative investment funds within the European Union (EU). Its primary focus is to regulate the fund manager, as opposed to regulating funds, and to impose obligations on their depositaries, administrators and external valuers. One key imposition is to increase asset safety throughout the custody holding chain, through defining the role of a depositary which is liable for the immediate restitution of any lost assets. Service providers such as custodians have typically been exposed only to liability for their fraud, negligence or wilful default – and, in the event of a loss of assets or other failing, a client has to prove the fault of the provider. Under AIFMD, the depositary will be liable to restore any client asset – or its cash equivalent – in the event of the asset being lost. There may be an exception to the liability for loss if it was outside the control of the depositary or custodian bank.

"AIFMD covers a notionally riskier segment of Europe's fund market: non-UCITS collective investment schemes, a category which includes hedge funds," explains Arnaud Claudon, Head of Depositary & Fiduciary Services for BNP Paribas Securities Services. "The directive brought in new rules on leverage, fund managers' remuneration policies and fund distribution."

Perhaps most significantly, AIFMD addressed the stark weaknesses in, and lack of harmonization of, the duties and liabilities of depositaries across different EU countries. The impetus for introducing a strict liability regime for those safeguarding investors' assets came in the wake of the default of Lehman Brothers in 2008 and, exposed in the same year, the Madoff investment scandal – in which the wealth management arm of Bernard Madoff's business ran an elaborate Ponzi scheme. With AIFMD substantially enhancing the investor-protection regime for professional investors, it was a natural consequence to extend this regime to retail fund investors – hence UCITS V. The new standard is to be applied across Europe imminently and may be adopted by some of the many countries in other regions which have adopted UCITS for local distribution.

The global fund market

Reproduced from our July 2014 special report, UCITS: where next, what next?

Largely mirroring AIFMD, UCITS V aims to impose the highest standards on fund depositaries, while also addressing perceived risks resulting from fund managers' pay practices.

Key implications for fund managers

"Under the incoming UCITS V directive, managers will have to set out remuneration policies that encourage a long-term investment view," Mr Claudon advises. "This means new transparency provisions, including the disclosure of specified details of management companies' remuneration policies, via fund prospectuses, annual reports and key investor information documents (KIIDs)."

There is a crucial need for all parties to ensure that the necessary information flows are in place to enable depositaries to meet their new legal responsibilities. With the significant step up in duties and liabilities, depositaries and other providers will look to managers to sign updated contracts, service level agreements (SLAs) and fee schedules.

Key implications for depositaries

Restitution – In common with AIFMD, UCITS V brings in a liability regime that places a responsibility on the depositary to compensate the fund in the event of a loss of assets held in custody. "This liability regime applies even if safekeeping has been delegated to a third party," notes Mr Claudon.

No transfer of restitution obligation – UCITS V goes beyond AIFMD, in removing the ability of a depositary to transfer the restitution obligation to a third party. Mr Claudon points out that these service providers will have to assess the impact of the new UCITS liability regime on their overall risk and capital levels. In practical terms, they will need to obtain updated legal opinions regarding asset protection in the case of the bankruptcy of a sub-custodian.

Oversight and safekeeping duties – UCITS V includes a uniform list of safekeeping obligations and oversight duties for depositaries, in order to achieve maximum harmonization among EU member states. With regard to safekeeping duties, UCITS V now distinguishes between financial instruments that can be held in custody by the depositary, and record-keeping and ownership verification requirements relating to assets that are not physically held.

Delegation of safekeeping – Depositaries frequently appoint third-party sub-custodians in countries of investment, which can pose significant risks to a fund. In mirroring AIFMD, UCITS V specifies strict conditions for the delegation of custody, including ensuring that the sub-custodian meets specified conditions. Where appointment of a sub-custodian is a requirement of local law, and no provider meets the requirements of UCITS V, a delegate may nevertheless be appointed – so long as the fund or its management company has expressly instructed the depositary to delegate to such a local entity and the depositary complies with certain disclosure requirements.

Reporting on assets safe-kept – Under UCITS V, depositaries will also have to report periodically on the assets held in safekeeping, notes Mr Claudon, as well as disclosing to investors the delegation chains, the reasons for delegation, evaluation of the delegate's ability and expertise, and identifying any potential conflicts of interest from the delegation of safekeeping duties. Information is expected to be placed on fund web sites and, in going beyond AIFMD, UCITS V requires the delegation details to be contained in the fund prospectus and to be made available by the depositary on request from an investor.

Timetable for UCITS V

It was back in July 2012 that the EU Commission issued a proposal for a UCITS directive with regard to depositary safekeeping and oversight duties, manager remuneration and sanctions. The directive entered into force on September 17, 2014. The EU's member states have 18 months – that is, until March 16, 2016 – to implement the directive into national law.

Recognizing the importance of the new European investor-protection regime, Luxembourg is the first mover. In July 2014, its securities regulator, la Commission de Surveillance du Secteur Financier (CSSF), issued a circular (CSSF 14/587) under which locally domiciled UCITS should comply with most of the UCITS V standards by the end of 2015.

"Whether facing an accelerated UCITS V implementation or not, fund managers and custodians will need to work closely with their service providers to ensure a smooth and efficient transition to compliance with the new regulatory standards," explains Mr Claudon. "Preparatory work, including the adaptation of standard contracts, internal training and client engagement can be undertaken even before the publication, in the summer or fall of 2015, of the detailed Level 2 texts of the incoming directive."

This site, like many others, uses small files called cookies to customize your experience. Cookies appear to be blocked on this browser. Please consider allowing cookies so that you can enjoy more content across globalcustody.net.

How do I enable cookies in my browser?

Internet Explorer

1. Click the Tools button (or press ALT and T on the keyboard), and then click Internet Options.

2. Click the Privacy tab

3. Move the slider away from 'Block all cookies' to a setting you're comfortable with.

Firefox

1. At the top of the Firefox window, click on the Tools menu and select Options...

2. Select the Privacy panel.

3. Set Firefox will: to Use custom settings for history.

4. Make sure Accept cookies from sites is selected.

Safari Browser

1. Click Safari icon in Menu Bar

2. Click Preferences (gear icon)

3. Click Security icon

4. Accept cookies: select Radio button "only from sites I visit"

Chrome

1. Click the menu icon to the right of the address bar (looks like 3 lines)

2. Click Settings

3. Click the "Show advanced settings" tab at the bottom

4. Click the "Content settings..." button in the Privacy section

5. At the top under Cookies make sure it is set to "Allow local data to be set (recommended)"

Opera

1. Click the red O button in the upper left hand corner

2. Select Settings -> Preferences

3. Select the Advanced Tab

4. Select Cookies in the list on the left side

5. Set it to "Accept cookies" or "Accept cookies only from the sites I visit"

6. Click OK

The UCITS hallmark is celebrated as the 'gold standard' for fund regulation globally. While originally envisaged as a fund passport for European markets, the UCITS structure is the vehicle of choice for distribution in many countries across all regions of the world – and has even proven popular in some countries which have mature domestic regimes.

UCITS has a particular focus on investor protection, especially in its fifth incarnation. The corresponding European Union directive – commonly called UCITS V – addresses a gap in regulatory standards exposed in 2014 with the introduction of the Alternative Investment Fund Managers Directive (AIFMD). In discussion with Arnaud Claudon of BNP Paribas Securities Services, we examine the pertinent issues for fund managers and their depositaries, administrators and external valuers.

AIFMD is an investor-protection measure governing the management and distribution of alternative investment funds within the European Union (EU). Its primary focus is to regulate the fund manager, as opposed to regulating funds, and to impose obligations on their depositaries, administrators and external valuers. One key imposition is to increase asset safety throughout the custody holding chain, through defining the role of a depositary which is liable for the immediate restitution of any lost assets. Service providers such as custodians have typically been exposed only to liability for their fraud, negligence or wilful default – and, in the event of a loss of assets or other failing, a client has to prove the fault of the provider. Under AIFMD, the depositary will be liable to restore any client asset – or its cash equivalent – in the event of the asset being lost. There may be an exception to the liability for loss if it was outside the control of the depositary or custodian bank.

"AIFMD covers a notionally riskier segment of Europe's fund market: non-UCITS collective investment schemes, a category which includes hedge funds," explains Arnaud Claudon, Head of Depositary & Fiduciary Services for BNP Paribas Securities Services. "The directive brought in new rules on leverage, fund managers' remuneration policies and fund distribution."

Perhaps most significantly, AIFMD addressed the stark weaknesses in, and lack of harmonization of, the duties and liabilities of depositaries across different EU countries. The impetus for introducing a strict liability regime for those safeguarding investors' assets came in the wake of the default of Lehman Brothers in 2008 and, exposed in the same year, the Madoff investment scandal – in which the wealth management arm of Bernard Madoff's business ran an elaborate Ponzi scheme. With AIFMD substantially enhancing the investor-protection regime for professional investors, it was a natural consequence to extend this regime to retail fund investors – hence UCITS V. The new standard is to be applied across Europe imminently and may be adopted by some of the many countries in other regions which have adopted UCITS for local distribution.

The global fund market

Reproduced from our July 2014 special report, UCITS: where next, what next?

Largely mirroring AIFMD, UCITS V aims to impose the highest standards on fund depositaries, while also addressing perceived risks resulting from fund managers' pay practices.

Key implications for fund managers

"Under the incoming UCITS V directive, managers will have to set out remuneration policies that encourage a long-term investment view," Mr Claudon advises. "This means new transparency provisions, including the disclosure of specified details of management companies' remuneration policies, via fund prospectuses, annual reports and key investor information documents (KIIDs)."

There is a crucial need for all parties to ensure that the necessary information flows are in place to enable depositaries to meet their new legal responsibilities. With the significant step up in duties and liabilities, depositaries and other providers will look to managers to sign updated contracts, service level agreements (SLAs) and fee schedules.

Key implications for depositaries

Restitution – In common with AIFMD, UCITS V brings in a liability regime that places a responsibility on the depositary to compensate the fund in the event of a loss of assets held in custody. "This liability regime applies even if safekeeping has been delegated to a third party," notes Mr Claudon.

No transfer of restitution obligation – UCITS V goes beyond AIFMD, in removing the ability of a depositary to transfer the restitution obligation to a third party. Mr Claudon points out that these service providers will have to assess the impact of the new UCITS liability regime on their overall risk and capital levels. In practical terms, they will need to obtain updated legal opinions regarding asset protection in the case of the bankruptcy of a sub-custodian.

Oversight and safekeeping duties – UCITS V includes a uniform list of safekeeping obligations and oversight duties for depositaries, in order to achieve maximum harmonization among EU member states. With regard to safekeeping duties, UCITS V now distinguishes between financial instruments that can be held in custody by the depositary, and record-keeping and ownership verification requirements relating to assets that are not physically held.

Delegation of safekeeping – Depositaries frequently appoint third-party sub-custodians in countries of investment, which can pose significant risks to a fund. In mirroring AIFMD, UCITS V specifies strict conditions for the delegation of custody, including ensuring that the sub-custodian meets specified conditions. Where appointment of a sub-custodian is a requirement of local law, and no provider meets the requirements of UCITS V, a delegate may nevertheless be appointed – so long as the fund or its management company has expressly instructed the depositary to delegate to such a local entity and the depositary complies with certain disclosure requirements.

Reporting on assets safe-kept – Under UCITS V, depositaries will also have to report periodically on the assets held in safekeeping, notes Mr Claudon, as well as disclosing to investors the delegation chains, the reasons for delegation, evaluation of the delegate's ability and expertise, and identifying any potential conflicts of interest from the delegation of safekeeping duties. Information is expected to be placed on fund web sites and, in going beyond AIFMD, UCITS V requires the delegation details to be contained in the fund prospectus and to be made available by the depositary on request from an investor.

Timetable for UCITS V

It was back in July 2012 that the EU Commission issued a proposal for a UCITS directive with regard to depositary safekeeping and oversight duties, manager remuneration and sanctions. The directive entered into force on September 17, 2014. The EU's member states have 18 months – that is, until March 16, 2016 – to implement the directive into national law.

Recognizing the importance of the new European investor-protection regime, Luxembourg is the first mover. In July 2014, its securities regulator, la Commission de Surveillance du Secteur Financier (CSSF), issued a circular (CSSF 14/587) under which locally domiciled UCITS should comply with most of the UCITS V standards by the end of 2015.

"Whether facing an accelerated UCITS V implementation or not, fund managers and custodians will need to work closely with their service providers to ensure a smooth and efficient transition to compliance with the new regulatory standards," explains Mr Claudon. "Preparatory work, including the adaptation of standard contracts, internal training and client engagement can be undertaken even before the publication, in the summer or fall of 2015, of the detailed Level 2 texts of the incoming directive."