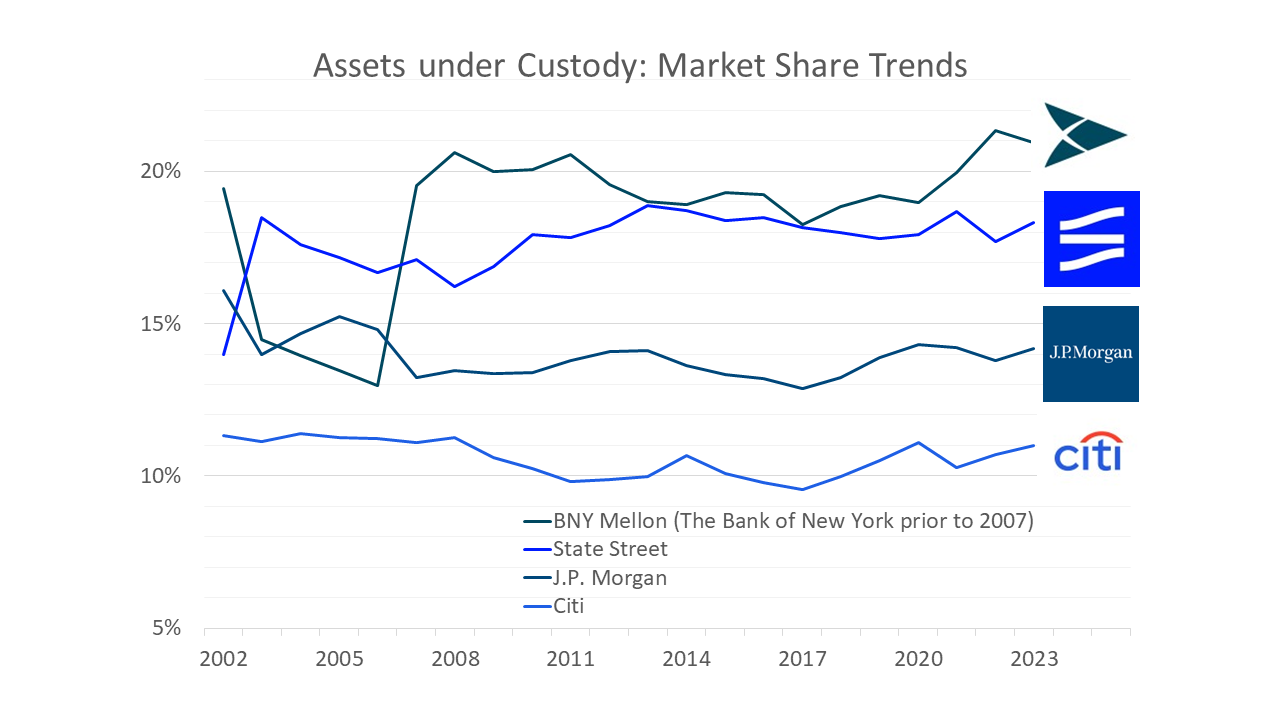

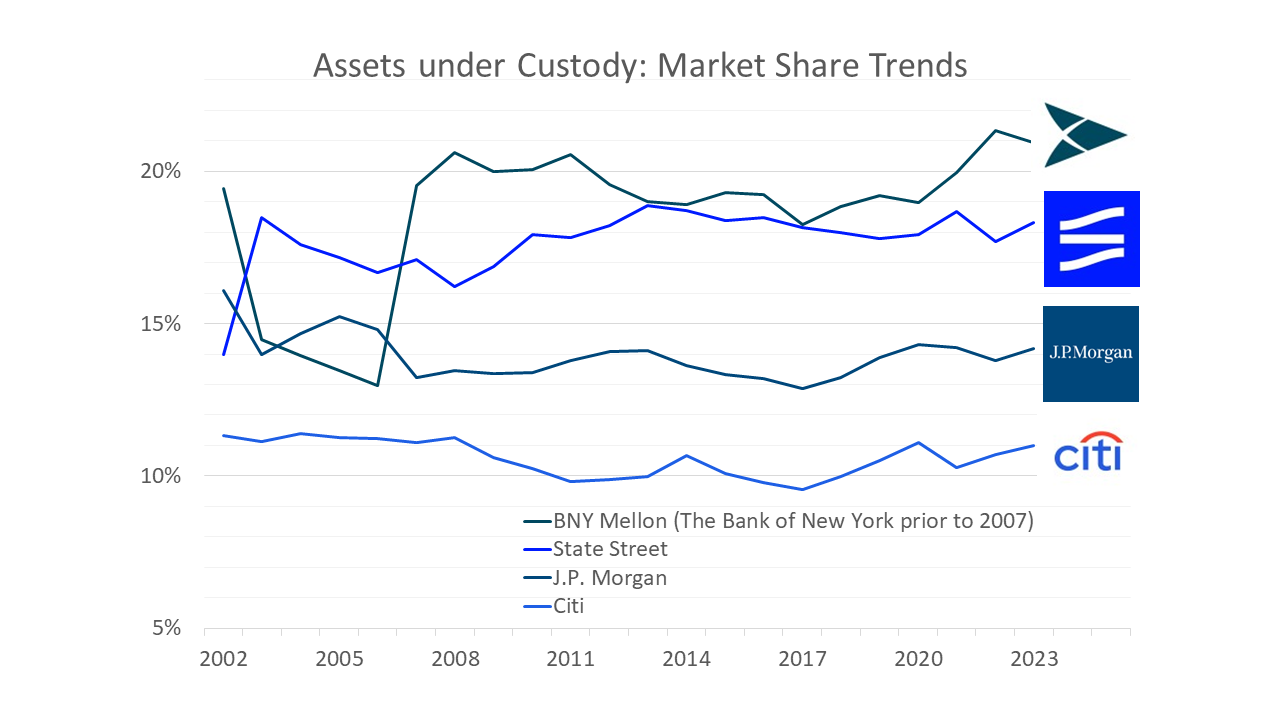

For 20+ years, we have recorded the Assets under Custody and Administration of the world's leading global custodians, gathering data across a market of more than 30 asset servicing firms. The accompanying chart depicts the market share of the 'big four' providers, BNY Mellon, State Street, J.P. Morgan and Citi over the past 20 years.

Merger and acquisition activity was prevalent in the early part of this period. State Street absorbed the global custody business of Deutsche Bank (2003) and then Investors Bank & Trust (2007) and Banca Intesa (2010). BNY Mellon, formed through the 2007 merger of The Bank of New York and Mellon Group, went on to acquire BHF Asset Servicing GmbH and PNC Global Investor Services in 2010. Citi acquired the investment services unit of Bisys Group, Inc (2007) and the local custody business of ING (2013).

Growth in assets under custody in the past decade has largely been organic, with the fastest-growing industry players winning more business (and losing fewer clients) than their rivals. It has been a quiet period in terms of wholesale acquisitions of competitors, with a peppering of M&A activity focused principally on expanding fund administration footprints and buying technology.

The data collected by us encompasses domestic and cross-border assets and extends to assets held by some service providers in the capacity of sub-custodian acting for third-party global custodians. The above chart is based on each provider's overall worldwide Assets under Custody and/or Administration.

This site, like many others, uses small files called cookies to customize your experience. Cookies appear to be blocked on this browser. Please consider allowing cookies so that you can enjoy more content across globalcustody.net.

How do I enable cookies in my browser?

Internet Explorer

1. Click the Tools button (or press ALT and T on the keyboard), and then click Internet Options.

2. Click the Privacy tab

3. Move the slider away from 'Block all cookies' to a setting you're comfortable with.

Firefox

1. At the top of the Firefox window, click on the Tools menu and select Options...

2. Select the Privacy panel.

3. Set Firefox will: to Use custom settings for history.

4. Make sure Accept cookies from sites is selected.

Safari Browser

1. Click Safari icon in Menu Bar

2. Click Preferences (gear icon)

3. Click Security icon

4. Accept cookies: select Radio button "only from sites I visit"

Chrome

1. Click the menu icon to the right of the address bar (looks like 3 lines)

2. Click Settings

3. Click the "Show advanced settings" tab at the bottom

4. Click the "Content settings..." button in the Privacy section

5. At the top under Cookies make sure it is set to "Allow local data to be set (recommended)"

Opera

1. Click the red O button in the upper left hand corner

2. Select Settings -> Preferences

3. Select the Advanced Tab

4. Select Cookies in the list on the left side

5. Set it to "Accept cookies" or "Accept cookies only from the sites I visit"

6. Click OK

For 20+ years, we have recorded the Assets under Custody and Administration of the world's leading global custodians, gathering data across a market of more than 30 asset servicing firms. The accompanying chart depicts the market share of the 'big four' providers, BNY Mellon, State Street, J.P. Morgan and Citi over the past 20 years.

Merger and acquisition activity was prevalent in the early part of this period. State Street absorbed the global custody business of Deutsche Bank (2003) and then Investors Bank & Trust (2007) and Banca Intesa (2010). BNY Mellon, formed through the 2007 merger of The Bank of New York and Mellon Group, went on to acquire BHF Asset Servicing GmbH and PNC Global Investor Services in 2010. Citi acquired the investment services unit of Bisys Group, Inc (2007) and the local custody business of ING (2013).

Growth in assets under custody in the past decade has largely been organic, with the fastest-growing industry players winning more business (and losing fewer clients) than their rivals. It has been a quiet period in terms of wholesale acquisitions of competitors, with a peppering of M&A activity focused principally on expanding fund administration footprints and buying technology.

The data collected by us encompasses domestic and cross-border assets and extends to assets held by some service providers in the capacity of sub-custodian acting for third-party global custodians. The above chart is based on each provider's overall worldwide Assets under Custody and/or Administration.