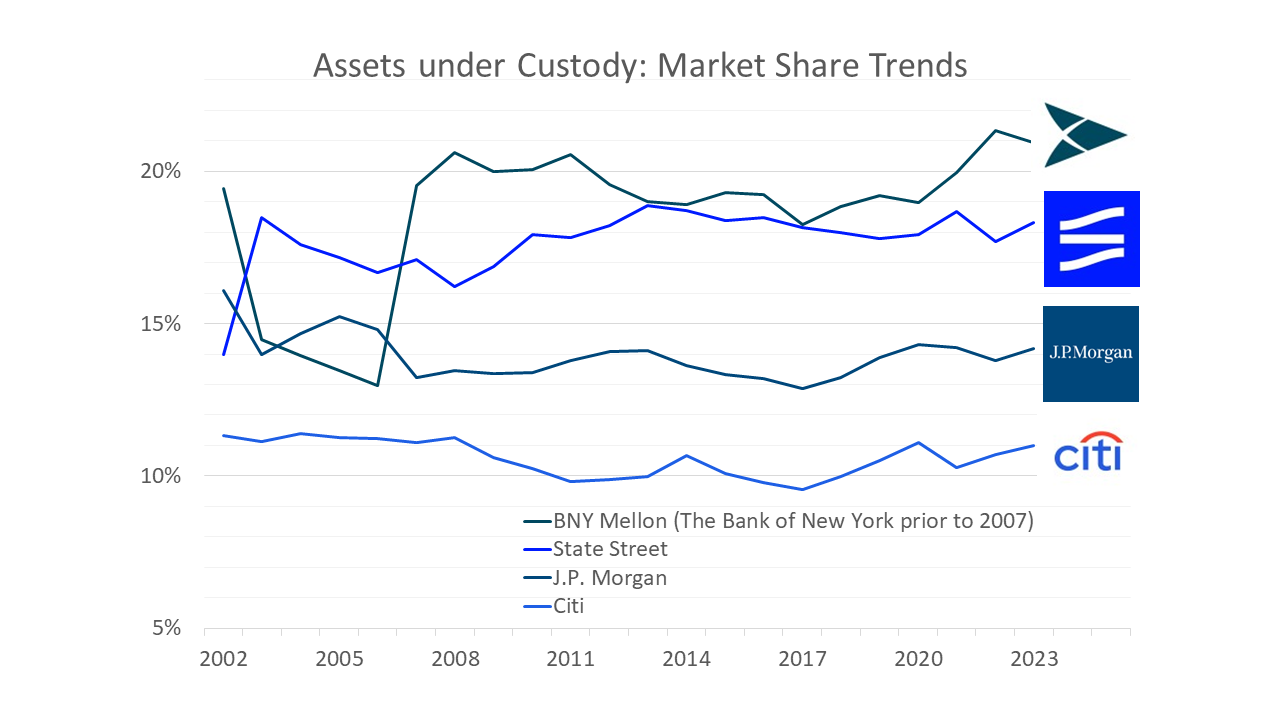

For 20+ years, we have recorded the Assets under Custody and Administration of the world's leading global custodians, gathering data across a market of more than 30 asset servicing firms. The accompanying chart depicts the market share of the 'big four' providers, BNY Mellon, State Street, J.P. Morgan and Citi over the past 20 years.

Merger and acquisition activity was prevalent in the early part of this period. State Street absorbed the global custody business of Deutsche Bank (2003) and then Investors Bank & Trust (2007) and Banca Intesa (2010). BNY Mellon, formed through the 2007 merger of The Bank of New York and Mellon Group, went on to acquire BHF Asset Servicing GmbH and PNC Global Investor Services in 2010. Citi acquired the investment services unit of Bisys Group, Inc (2007) and the local custody business of ING (2013).

The data collected encompasses domestic and cross-border assets and extends to assets held by some service providers in the capacity of sub-custodian acting for third-party global custodians. The above chart is based on each provider's overall worldwide Assets under Custody and/or Administration.